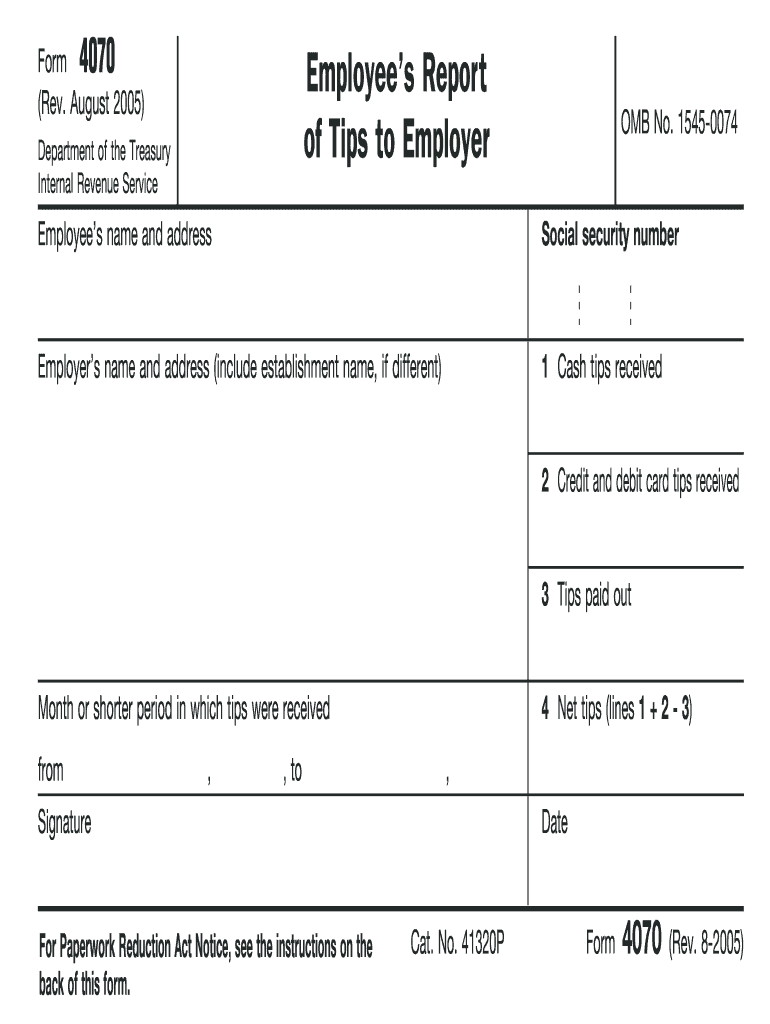

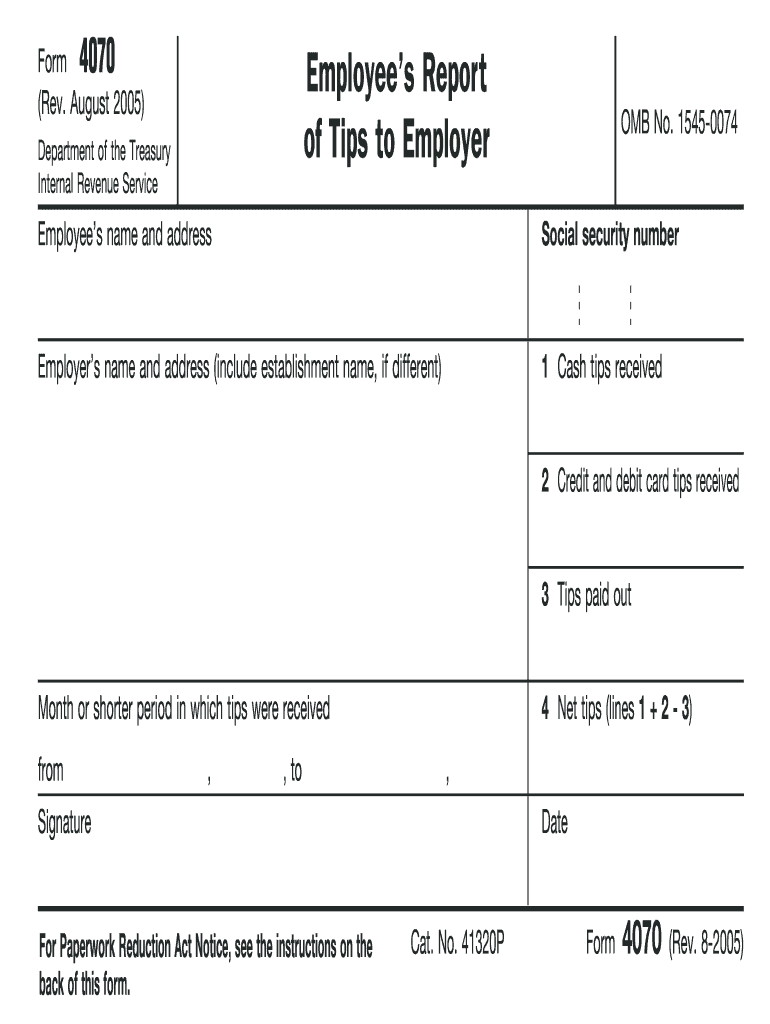

Get the free form 4070

Get, Create, Make and Sign

How to edit form 4070 online

Video instructions and help with filling out and completing form 4070

Instructions and Help about form 4070a employee's report of tips

This machine is a sharp MX 4070 it's a 40-page per minute multifunction color copier with network printer network scanner it also has faxed it's got five paper trays four in the front plus the bypass on the right it comes the upgraded internal stapling finisher the meter on this machine reads only 90000 total black-and-white copies and seventy-nine thousand total color copies as you can see here on our counter is our color copy test chart, and we'll just go ahead go to the easy copy feature here it's adjusting the print quality here an automatic feature on this machine it also has the document feeder on top of the machine for multiple page jobs and two color copies alright and once again this machine is 40 pages per minute color and black and white, so that was the first Prince of the day, so I'm trying to put a couple more right here just to give you know a better idea of the copy speed machines still kind of warming up there all right here we have our test copies we're going to place them on the glass next to our chart and as you can see from the test copies to the right and the test chart to the left a good color image on this machine all right now we'll go ahead, and we'll test out the document feeder as well as the stapling feature on our finisher got four copies here since we're in two, so we'll just put all four up there we'll run that job through once, and it gives you the stapling option it actually has a single staple a double staple and that it also has an indentation staple which it kind of makes an imprint on the page and staples it's a staple is staple pretty much, but we'll run that job through once, and we'll do the double staple alright once again this machine is a sharp MX 40 70 it's a 40-page per minute multifunction color copier with network printer network scanner it also has faxed it's got five paper trays four in the front plus the bypass on the right the upgraded internal stapling finisher like I said it also has the indentation staple as' stapler and here we have our test copies stapled through the document

Fill 4070 irs form : Try Risk Free

People Also Ask about form 4070

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your form 4070 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.